It seems that the subject of making a Will is something that most people simply want to avoid as much as possible. Every survey ever done about the topic shows that the majority of adult Americans have not made a Will. We just avoid the subject and dig our heads in the sand. But you need a Will. No matter what your circumstance, you need a Will.

No doubt there are many reasons for the excuses. None of us wants to think about our own mortality. Some people are even superstitious enough to think that making a Will might hasten our own demise. However, even if you do not have a penny to your name, you should make a Will.

A recent article from Porch.com summarized the key reasons for writing a Will and the need for estate planning.

There are a lot of myths and misconceptions about making a Will. Here we talk about the confusion that people have about the reality of why you need a Will.

I Am Not Rich – I Don’t Need a Will

This is a very common mistake that people make. You may see a Will as something that only very wealthy people need. However, if you are an adult, you need a Will. Even if you have very few assets it is still a good thing to make a Will. It makes things very much easier for your loved ones to deal with your estate when you die – even if there isn’t that much to distribute.

Many people have more assets than they think they have. You don’t have to have tens of thousands of dollars worth of assets to make it a good idea to have a Will. What about that savings account that you have? Or your diamond ring that has been in the family for years? Your car? Most people have something of value which would need to be distributed if anything happened to you. Wouldn’t you prefer to have the peace of mind in knowing that your loved ones will be aware of how you wanted your things to be dealt with?

Are you sure you own nothing?

Take an honest look at what you have and think about what would happen to it if something happened to you. Doesn’t it make sense for you to make a Will to make things easier for the people left behind?

The other important note is that your Will is probably not going to come into effect today. It will come into effect at some time in the (hopefully) distant future. You have no idea how much your estate will be worth at the time you die. Just supposing you were hit by a bus, but the bus driving was texting at the time. The bus company was found to be negligent and your estate won a $5M payout. Your Will gives you an opportunity to describe the distribution of your estate, and even include special bequests like charitable donations.

You need a Will.

I Don’t Need a Will as I Have Nothing To Leave to Anyone

You also need to remember that Wills are not just about how you want your money and property distributed. There are a number of other things that your Will covers.

If you have minor children, you need a Will. You may think that it will be fine as your family will take care of your children if you die. However, the reality is that if you die without appointing a guardian, a judge will decide who is legally responsible for your child. Many parents do not realize the consequences if they do not make a Will. You can appoint a guardian for your children and make sure that your wishes are heard. If it is left up to a judge you will have no control over who is appointed to take care of your children.

Digital assets

In this internet age we must also think about a different type of asset which many of us have – Digital assets. This can range from email and social media accounts, to websites and domains that we might own. Some of these can have a monetary value – that blog you started as a hobby may actually be worth something. Certainly any domain names that you may own. Don’t forget about your social media accounts either. These mostly likely do not have a monetary value, but they are your property. It can be very difficult for a family member to deal with your social media or online accounts if they have no idea about your passwords and how you want the account to be dealt with.

Take your Facebook account as an example. You might want the account deleted after you die. However, another option that you may want is to memorialize your account. This means that your account will remain online and that your page becomes a place where people can celebrate your life by leaving comments. This means that photos on the account can still be accessed. You can use your will to make your wishes known.

The reality is that a Will is about so much more than simply dealing with who gets your money. Even if you think you don’t own many assets, you still need a Will.

I am Too Young To Make a Will

If you are of legal age you are not too young to make a Will. In most states this is 18. You may not think that you have any assets or that you have many decades left to even start thinking about such a thing. However, it really is never too early to start thinking about these things. Unfortunately, some people do not reach old age. No one wants to think about this subject but accidents do happen. You may not have much to leave, but you probably have something.

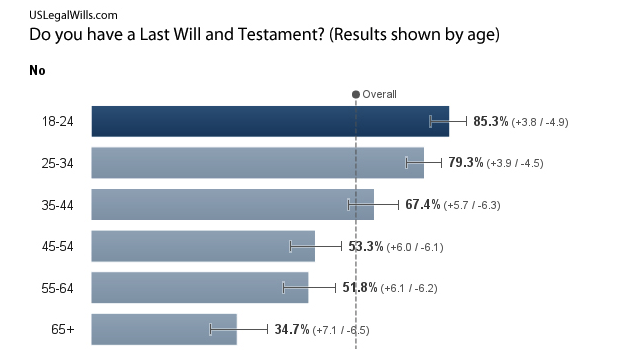

Most people do not even start to think about making a Will until they are into their thirties and forties. Just because other people make that mistake does not mean that you have to as well. In our recent survey, we found that although people started to prepare a Will as they got older, there were still way too many people without a Will.

Number of Americans without a Will by age

We often hear the phrase “Fortunately, I don’t need a Will yet”. This implies that the plan is to write a Will just before they die. There are at least two good reasons why this is a bad plan. Firstly, of course, you don’t know when you will die. But some people also overlook the important consideration that you must have full mental capacity when you prepare all of your estate planning documents. We sadly hear from people who tell us that their elderly parent now has dementia and they don’t have a Will. At that point, it’s too late. This elderly parent will die without a Will.

I Can’t Afford to Make a Will

The truth is that for most people, making a will does not need to be expensive. Gone are the days when your only choice was to go to an expensive lawyer or estate specialist and have them draft your Will for you. There are relatively few situations when you need complex legal advice about your estate. This is usually only applicable to those with unusually complicated assets and financial situations.

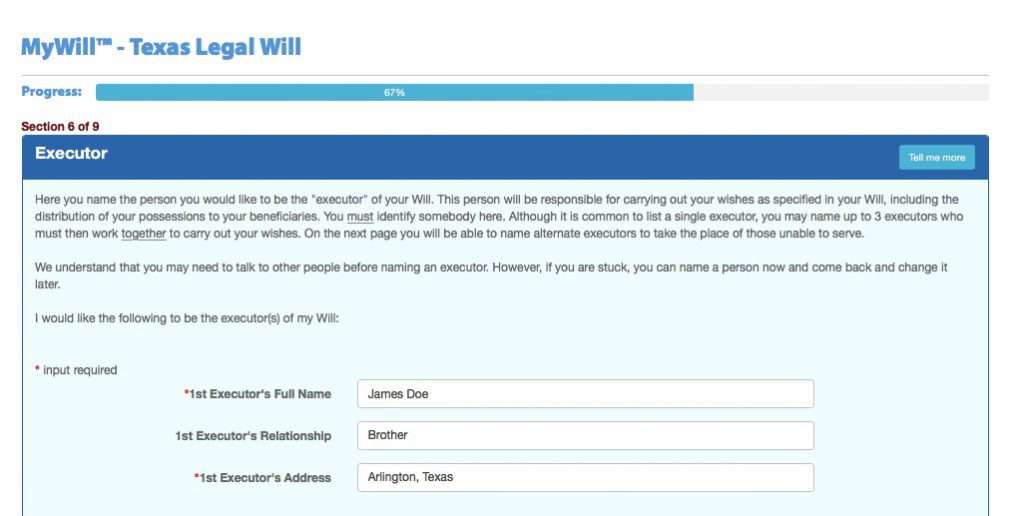

Many people now choose online services to make a Will. At USLegalWills.com it costs $39.95 to prepare a Will, and this gives you one year of unlimited updates to your document.

An online Will service like ours will take you through the process of making a Will step by step. It is very easy and doesn’t take much time.

Try and put this cost in perspective. This is one good meal out. Probably less than 10 visits to Starbucks. Less than a trip to the movies for a family of 4.

Isn’t that a small price to pay for peace of mind for you and your loved ones? Making a will is such an easy and inexpensive thing to do. It makes a huge difference when you die for those people who are left behind.

My Spouse Will Get All My Money When I Die

This is a popular, but rather dangerous myth. If you do not make a will the rules of intestacy will take over. The laws of intestacy very from state to state. However, the bottom line is that if you die without making a Will your estate could well be distributed in a way that you definitely did not want it to be.You will have no control and could leave your family and loved ones in a very difficult situation.

For example. If you live in California and have a spouse with no children. Who will receive your estate? your spouse? WRONG.

Did you know that your parents will receive half of your property and your spouse will receive the other half.

Case study 1

Let us have a look at the consequences for a surviving spouse if you did not make a Will in Florida. The rules vary a lot between states, but we are looking at Florida just to show you how the consequences of dying without a Will may be a long way away from what you want.

If you have a spouse but no children, your spouse will inherit everything.

If you have children but no spouse, your children will inherit everything.

However, if you have a spouse and you had children from another relationship the situation is that your spouse will not inherit all of your estate. The spouse will inherit half of your estate and all children will inherit the other half. How would this work? Say you had an estate of $1 million and you were married. You had 2 children with your spouse and 3 children with your ex spouse. Your current spouse would inherit half of your estate, so $500,000. The remaining $500,000 would be split between your 5 children. Therefore, each of your children would get $100,000 each. The most serious consequence of this is that in all likelihood, your Executor would have to sell your house.

Case study 2

Now let us look at what would happen in the state of Virginia.

If you have a spouse and no children, things are the same as Florida and your spouse would inherit all of your estate.

Things would also be the same if you have children, but no spouse your children will inherit all of your estate.

However, if you die intestate in Virginia and have a spouse and a child, at least one of which is from another relationship, the situation is very different. Your spouse would inherit only one third of your estate. So in the $1 million example, your spouse would inherit $333,333. The remaining $666,666 would be distributed equally between your children.

Not just for large estates

Remember too that we are not just talking about $1 million estates. It applies no matter how small or large an estate is. If you leave an estate of $100,000 in Virginia you might think that your spouse would be well provided for. However, would you still think that if you knew that your spouse would only get one third of that amount? Again, it probably means that your Executor would have to sell your house.

The only way to protect your family from the law of intestacy is to make a Will. There really is no reason to avoid it any longer.

Tim Hewson is one of the founders of USLegalWills.com.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets, and has contributed to articles in The New York Times, NY Metro Parents, U.S. News & World Report, and other leading publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...