A number of surveys over the last few years have reported that anywhere from 55 percent to 64 percent of Americans have not written their Wills. However, one under-reported statistic is the number of people who have their Will in place, but made it so long ago, that it no longer reflects their current circumstance. At USLegalWills.com we wanted to explore the current state of Will writing in the US, and delve deeper into the issue of outdated Wills.

Executive summary

The USLegalWills.com survey was conducted within the United States by Google Consumer Surveys, June 2016, among 2,012 adults aged 18 and older, and has a root square mean error of 1.4%.

Results are weighted by age, gender, and region. For full information on Google Consumer Surveys’ methodology and validity, visit here.

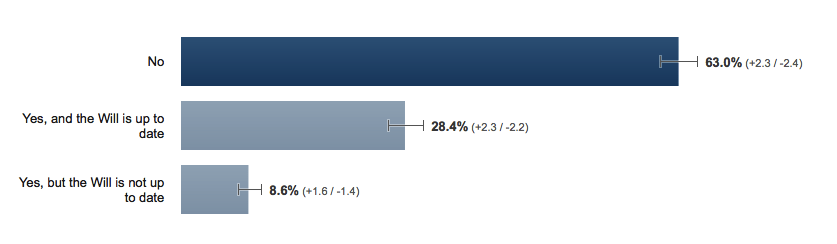

- Across all age groups 28.4 percent of Americans had up-to-date Wills. 8.6% had a Will but it was out-of-date. 63% had no Will at all. This means that 71.6 percent of Americans do not have an up-to-date Will.

- Even when we focus on Americans over 35, two thirds don’t have an up-to-date Will.

- Only half of Americans over the age of 65 have up-to-date Wills in place.

- One in six Americans over the age of 65 have a Will that is out of date.

- Wealthy Americans are no more likely to have written their Will.

- Wealthy Americans are more likely to have an out-of-date Will.

Number of Americans without Wills

Our aggregated numbers show that 71.6 percent of Americans do not have an up-to-date Will. We rarely see the number of out-of-date Wills reported, but it makes a significant difference to the story and clearly demonstrates that there are significant improvements needed in the way that Will writing is presented to Americans.

We know that everybody needs a Will, and consistently over the years we’ve heard that around two thirds of Americans don’t have their Wills in place, but now knowing that nearly ten percent have an out-of-date Will adds to this concern. Continue reading →