What are blended families?

Blended families is a term that includes families for whom one or both partners have children from a previous marriage. In other words, your spouse may not be the biological parent of your children. Blended families have become increasingly common, especially as the divorce rate in many countries including the United States hovers around fifty percent. There are several nuances that emerge when you write a Will for a blended family situation.

Blended families have to balance bequests between children from previous marriages and the current marriage.

Put simply, if you leave everything to your spouse in your Will, and they are not the biological parent of your children, there is every chance that their life would move on. There is then a distinct possibility that your children may not even be a factor in their estate plan.

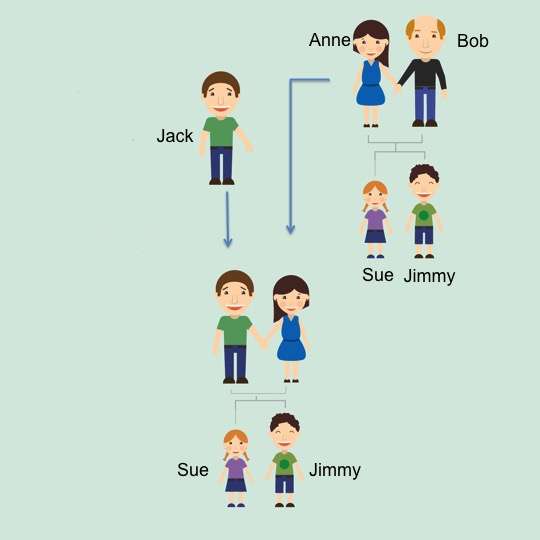

Blended Families illustrated

Let us take the following scenario:

Anne marries Bob, and has two children Sue and Jimmy. For whatever reason it doesn’t work out, maybe Bob died, or Bob and Anne went their separate ways and divorced.

Anne then found a new life with Jack and they continued to live together raising Sue and Jimmy. Maybe Anne and Jack become husband and wife.

Anne writes a fairly typical Will leaving everything to Jack with an alternate scenario leaving everything to the children if Anne and Jack were ever together in a common accident. Sadly Anne dies.

Anne’s entire estate will now go to Jack. But really Jack never thought of Sue and Jimmy as his own children, particularly if they were adults by this time. Many years later Jack dies and leaves everything to…..his new family whoever they may be.

This is a very common scenario and it means that Sue and Jimmy inherit nothing. Everything that was owned by Bob and Anne went to Jack, and Jack left nothing to Sue and Jimmy. After all, they weren’t even his children.

Other considerations for Blended families

Blended families may have additional obligations attached to their estate, such as the continuation of child support payments. You would have to review your documentation thoroughly to make sure that you do not have any additional obligations to your ex-spouse that you are not aware of. You would also have to check that you have not forgotten to remove your ex-spouse from not only the assets listed in your Last Will and Testament but also from retirement and insurance documentation, as the Documentation Preparation Service of Fairfield rightfully points out that recent legal precedent has the listed name on these documents as overruling your Will.

Divorce, common law status, and your Last Will and Testament

In most States, divorce automatically removes the spouse as executor and beneficiary. Similarly, a new marriage usually revokes (cancels) an existing Will. Again, depending on your State. If you are in a blended family you should be aware of the specifics of estate planning law in your State and also understand who is named as a beneficiary on your retirement and insurance accounts. Although Wills are fundamental for everyone and the cornerstone of responsible estate planning, they are especially necessary for common law partners, as common law couples are not given the same presumptive legal benefits that married couples are.

What strategies are available to blended families to ensure a harmonious probate process?

A common strategy in blended family situations is to create trusts to distribute your assets. Some trusts may allow a spouse to reside in your married home as long as they are alive. But you can then leave the home to your children after their death. This can prevent a new spouse from disinheriting children from a previous relationship. This would be distinctly possible assuming you have a standard Will. These are often called spousal trusts or family trusts. Trusts that are handled by a third party can be more impartial, and thus more true to the spirit of your Will, than family members sometimes can.

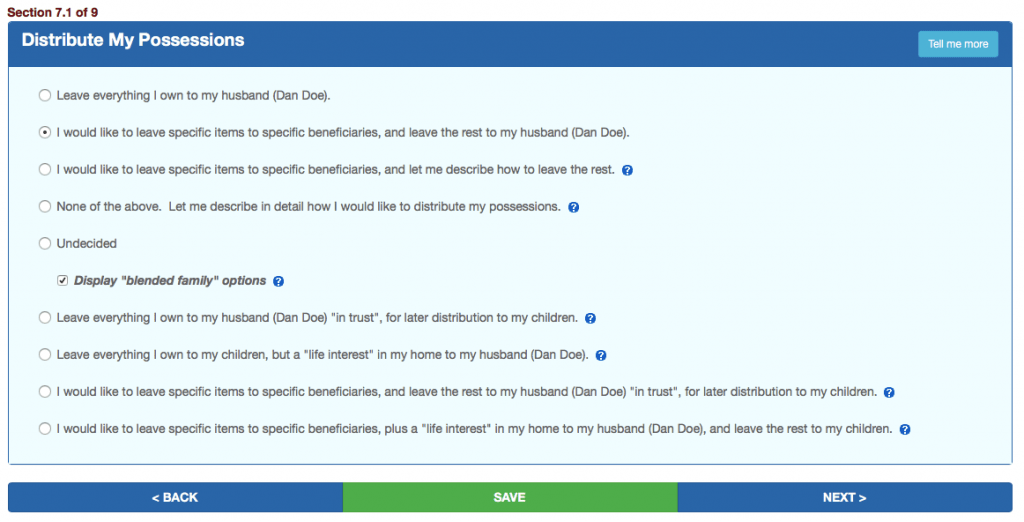

At USLegalWills.com we present unique options for blended family situations within our service at the time of describing the distribution of your assets.

The new options allow you to leave either your entire estate, or your home in trust to your spouse. But on the death of your spouse, it then passes to your children, who in this context are the “remainderman” or “remaindermen”. The trust actually belongs to the children, but your spouse benefits from it while they are alive.

As soon as your spouse dies, the asset(s) goes to your children. It never becomes a part of your spouse’s estate to be distributed according to their own Will..

Online Will services and Blended Families

If you find yourself in a situation where your spouse is not the biological parent of your children, be very careful when preparing your own Will. And be particularly careful in using online Will services. We have reviewed a number of online Will services, and very few adequately handle this situation, because it’s tricky.

At USLegalWills.com we introduced support for spousal trusts within the last year, after offering our service for over a decade. It is a sophisticated estate planning tool and one that most online Will writing services do not adequately support.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020