Writing your Last Will and Testament is a very important step to protect your family and loved ones. It allows you to make key appointments, and also describe the distribution of your assets. But it is only step part of a complete estate plan.

At USLegalWills.com we offer a complete estate planning service – you are able to create all of the documents that you need in one place. In this article we will describe all of the documents that make up a complete estate plan. We will explain the role of each document, and let you know how and where you can create each document.

There is a difference between writing a Will, and creating your complete estate plan. Here are the documents that you need.

Table of Contents

A Last Will and Testament

What is it?

A Last Will and Testament serves two important functions. It allows you to make key appointments, and then allows you to describe the distribution of your “assets” (everything that you own).

In your Will you can name an “Executor”. This person has responsibility to carry out the instructions in your Will. They have a very important role to play. Your Executor must locate, gather and secure your assets. They must take care of the administration of your “estate” (including working with State and Federal tax authorities). They hold all of your assets in trust for the distribution to your beneficiaries.

Your Executor is responsible for arranging the payment of your debts, taxes and funeral expenses from the estate. As well as working with the beneficiaries to give everybody their appropriate share.

In addition to naming your Executor, your Will allows you to name a guardian for your minor children. If neither parent is available (for example, you are both involved in a common accident), then you can decide who you would like to raise your children on your behalf.

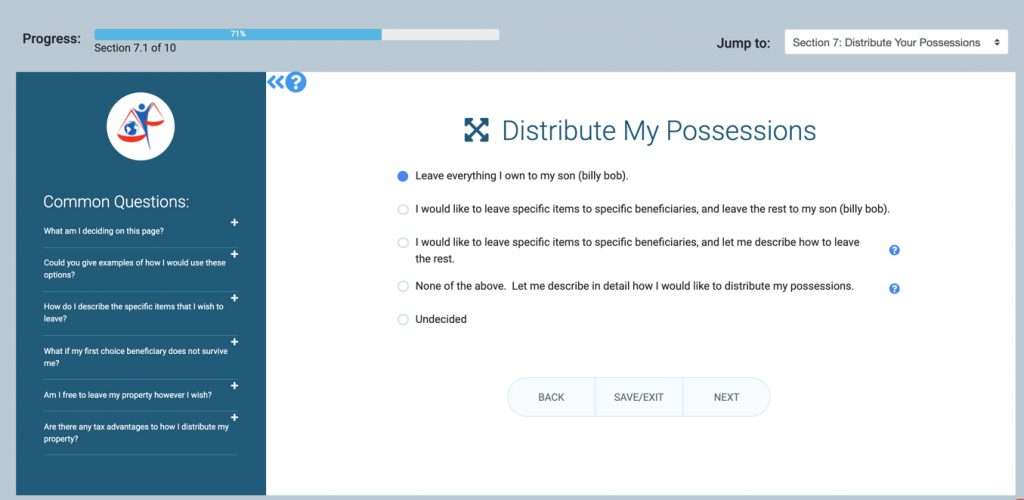

Finally your Will allows you to describe who will receive what through a series of “bequests”.

Bequests can be sums of money, possessions or even a percentage of your estate. For example, the simplest of Wills simply states “I leave my entire estate to my wife Jane Doe”.

But you can if you wish leave specific items to individuals. For example, you can leave your piano to your niece.

Or you can leave a sum of money to a person or organization. For example you can leave $1,000 to your nephew, or $5,000 to your local church.

You can also leave a percentage of your estate to an individual or organization. For example “divide my estate in equal shares between my three children”. Or “leave 5 percent of my estate to the Make a Wish Foundation”.

What happens if I don’t have a Will?

Dying without a Will is generally not an issue for yourself. It is a disaster for anybody you have left behind.

Firstly, you have not put anybody in charge of your estate. The immediate consequence of this is that your assets are not secured. It very much depends on your family situation, but it is not uncommon in this situation for family members to start fighting over who should receive what.

Even if you have one obvious person who will take charge of your affairs. They still need to receive authorization from the courts, so you can end up in a situation like Chadwick Boseman who died without a Will, and left his wife to apply through the courts to be appointed estate administrator. Probably the last thing she wanted to be doing during her grieving period.

If you have minor children and both parents are involved in a common accident, then a judge in a courtroom will appoint guardians on your behalf. The judge will take into account various applicants’ financial status, relationship, geographic proximity and make the best selection they can.

The judge may, or may not select the person that you would have chosen to raise your children.

Finally your assets will be divided according to the “intestate laws” of your estate. If you do not create a distribution plan for your estate, your State government already has one for you. But this plan can not only create problems, it is a huge missed opportunity.

For example, if you live in New York, and you are married with two children then your spouse will inherit the first $50,000 of your estate, plus 1/2 of the balance. You children will inherit everything else.

But of course, every State is different with this distribution plan, and the intestate distribution plan rarely matches what a person would describe in their Will.

The lack of plan and direction is unfortunate, but often it is the missed opportunity that is more sad. Your Last Will and Testament gives you a chance to recognize people and organizations that have impacted your life.

Aretha Franklin died without a proper Will. Her estate was worth $80M. Her $80M estate is in the process of being consumed in legal fees with various claimants trying to receive a piece of the estate through a lengthy courtroom battle. Prince also died without a Will, and his estate is also evaporating through legal fees.

These two multi-millionaires and countless others who have died without a Will have missed the opportunity to make a difference. They have left a legacy of their music, but they could have left a significant financial legacy, like a trust fund to aware scholarships to aspiring musicians in their home town. The Aretha Franklin scholarship fund could have impacted thousands of young musicians. But instead the estate is going to law firms and courtroom expenses.

Where can I get a Will?

There are essentially three approaches to writing a Will:

- You can write it yourself, or use a blank form do-it-yourself Will kit. People often confuse this with a “holographic Will”. But a holographic Will is a very special format of Last Will and Testament. The document must be written entirely in your own handwriting, and is unique because it doesn’t have the usual legal requirements of two witness signatures. It is designed to be used in desperate situations where you may feel that death is imminent, and you may not have access to two witnesses. The great thing about a holographic Will is that it doesn’t cost anything to prepare. However, a well drafted Will is a difficult document to write with no training. More importantly, a holographic Will is not legally accepted in all States. You can prepare your Will using a kit and have two witnesses watch you sign, and this would be accepted in all US States, but it still may not be a very well drafted document. It is very common to make mistakes with do-it-yourself blank form Will kits.

- You can prepare your Will with an estate planning attorney. This is usually the best approach if you have a complicated estate and feel that you would benefit from receiving legal advice. Of course, not all lawyers are estate planning attorneys, so you need to make sure that you find a specialist in this area. The two main downsides of this approach are that it is expensive: regularly over $1,000, and not very convenient. You would usually need to book at least a two or three meetings with the attorney at their office, co-ordinated with a spouse or partner if you have one. And if you need to update your Will, you would need to go through the whole process and expense again.

- Thankfully there is a way to prepare a professional grade Last Will and Testament in a more affordable and convenient way. Through one of a growing number of online Will writing services like the one at USLegalWills.com. These services guide you through the process of preparing a Will in a similar way to tax preparation software.

The whole process takes about 20 minutes, and the final product is a four to five page document that is often word-for-word the same as if you worked with a lawyer to prepare your Will.

Over the years, online Will writing services have become more sophisticated, so they are no longer designed only for the simplest of scenarios. For example, the service at USLegalWills.com includes pet trusts, lifetime interest trusts, trusts for minor beneficiaries. You can even prepare complementary Wills to cover assets in specific countries outside of the US.

How much does it cost to write a Will?

We have written an entire article on this topic, because it is confusing. How can it possibly cost zero dollars, and at the same time cost $1,000, are you getting the same thing?

You can write your own Will on a blank piece of paper, and often this costs absolutely nothing. The problem with this approach is the Will might not actually be very good.

Many online services offer “Free Wills”. But in reality, there are only three ways in which a Will service can be offered at no charge.

- It’s a very poor service. It hasn’t been created with a legal team, it offers no support, is not kept up to date and the final document probably wouldn’t go smoothly through the probate process.

- It claims to be free, but then charges your credit card automatically every month.

- It sells your personal data to other businesses like insurance companies and pre-paid funeral homes.

Reputable online Will writing services cost anything from about $35 to $100 to prepare a Will. There are some differences between the different services, but these differences do not necessarily correlate to the price charged for the service. For example, the service at USLegalWills.com is one of the more affordable, but in fact, one of the most comprehensive.

At the high end, estate planning attorneys can charge anything from $500 to over $1,000 for a Last Will and Testament. With this, you do have the opportunity to ask for legal advice, and you are paying for knowledge of the law. However, if you do not have any particularly complicated legal issues associated with your plan, you are usually paying for expertise that you are not using.

A Financial Power of Attorney

What is a Financial Power of Attorney?

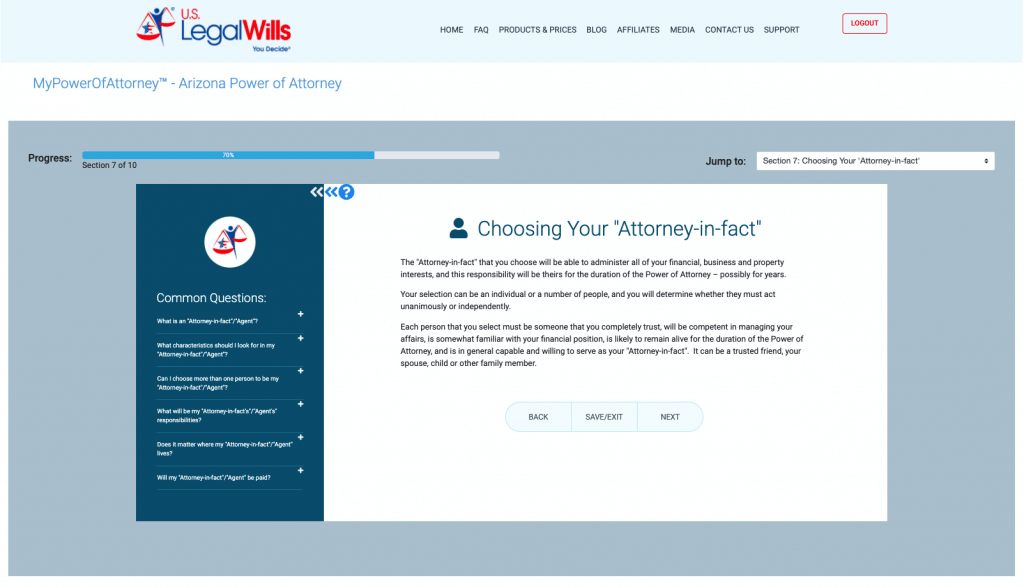

A financial Power of Attorney is a document that names somebody else to take care of your financial affairs. There are many different types but at least one of these is considered to be an important part of a complete estate plan.

Firstly, a Financial Power of Attorney (or PoA) can be “specific” or “general”. A specific PoA allows you to name somebody to take care of a particular transaction. For example, if you were overseas and needed somebody to sell your car on your behalf. You could create a specific PoA for the sale of your car. A General financial PoA gives somebody general powers to handle all of your finances on your behalf. Usually, this is in place because you have lost the capacity to handle your own financial affairs.

A general financial PoA can be “immediate”. “springing” or “enduring”. These all refer to the time period when the document is in effect. The important point to note is that when you prepare a financial PoA, you must have mental competence to do this. If you are writing the document as part of your complete estate plan, you would usually set it up to come into effect only, if you were to lose capacity. This is called a “springing” financial PoA. It is also referred to as an “enduring” financial Power of Attorney because it “endures” or stays in place, even though you have lost capacity.

At USLegalWills.com you can prepare a general enduring financial Power of Attorney. For most states you can also prepare an immediate financial PoA, but this has a very specific purpose. State law varies quite significantly with financial PoA’s. For example, in Florida, since 2011, you cannot create a springing financial PoA.

What happens if I don’t have a Financial PoA?

If we restrict the discussion to the Financial PoA that is part of a complete estate plan, then a few things can happen if you were to lose capacity.

Sadly, one of the most common situations is that you can become a victim of fraud and coercion. It is unfortunately all too common to see elderly people being swindled out of their life savings. Sometimes it is not entirely clear whether the action is fraudulent: like the ongoing subscription to mail order catalogs, or requests from charities. Beyond this is the plea to help less fortunate, or children of friends and family members. It’s all very messy and not entirely clear which expenditures are legitimate, or which are taking advantage of a senior. Sometimes, it makes sense for somebody else to take control to protect a senior’s life savings. It is common for seniors with mental health challenges to maintain a firm grip on the value of different sums of money.

In addition, legitimate bills do need to be paid. You may have healthcare expenses, or nursing home expenses. It may become overwhelming to manage the numerous medical bills, and it might be a good idea for somebody else to step in to handle this paperwork.

Where can I get it?

A Financial Power of Attorney is usually not a very complicated document. You would be naming a person to serve in the event of incapacity or inability to handle your own affairs. Usually this is determined by two attending physicians.

The document then describes various powers being granted to the “Attorney”.

Any service provider that offers Will writing services would usually offer financial Power of Attorney services. We certainly do at USLegalWills.com.

You could in theory write your own, but the document would have to be signed in the presence of two adult witnesses. Although it is not a complicated document, it does usually have some specific legal language, so it is usually best to find a template.

As previously noted, the Power of Attorney laws vary significantly from State to State, so if you do find a downloadable form on the internet. Make sure that it is State specific and up-to-date (laws change).

How much does it cost to write a PoA?

You can download a free form from the internet, or you can work with an estate planning attorney. Typically, a Financial Power of Attorney does not draw upon a great deal of legal knowledge, so the PoA is usually bundled with Will writing as a complete estate plan.

The cost for a financial PoA at USLegalWills.com is $29.95. It is usually unnecessary to pay more than this. A more expensive document is likely to be exactly the same.

A Living Will

What is a Living Will?

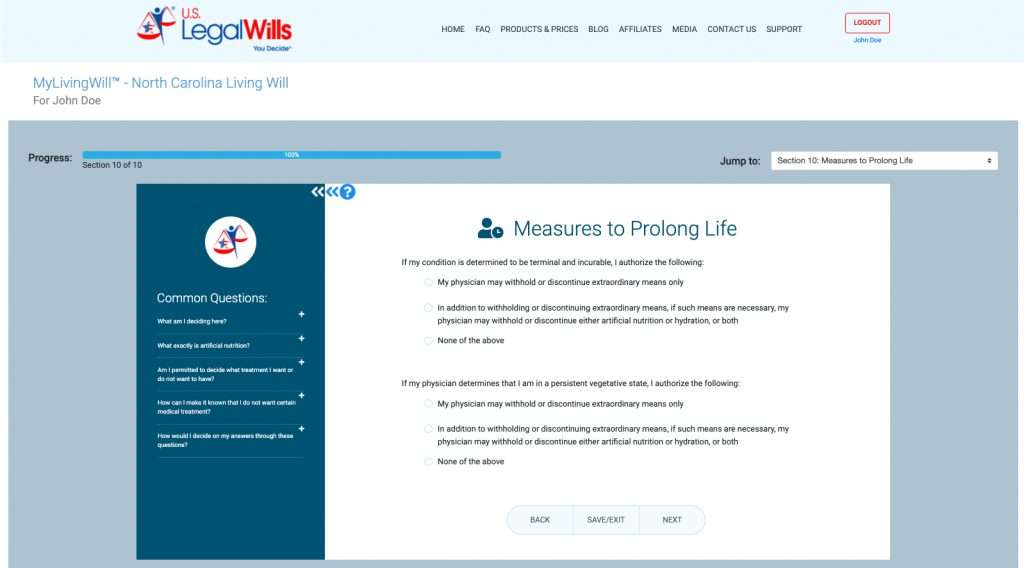

A Living Will is usually made up of two separate documents. The first is the naming of a substitute decision maker, often called a Healthcare Power of Attorney, or Healthcare Proxy.

This document would come into effect if you were unable to communicate, and attending physicians needed to make decisions regarding your medical treatment. The physicians would need to turn to somebody to help with that decision, and sadly it is all too common for family members to not always agree. Your Healthcare Power of Attorney names a single person with decision making powers.

Together with this document is your “Advance Directives”. This is your expression of the treatment you would wish to receive if you were ever in an irreversible terminal condition. Whether you would like to be resuscitated, artificially kept alive, tube fed, and kept alive even if you have no chance of recovery. These are heart wrenching decisions for family members to make. It is a gift to have outlined your wishes in an Advance Directive document.

What happens if I don’t have a Living Will?

Of course, you may never be in the situation where your Living Will comes into effect. It is a document that is only ever used if you have lost capacity, you are usually in hospital, often in a coma, and possibly with no chance of recovery. However, if you are ever in this situation, the document can be a tremendous help for your family.

The most often cited landmark case was with Terri Schiavo in Florida. Family members could not agree on the correct course of action and legal proceedings continued for ten years, right through to the US Supreme Court. The animosity between family members persisted even after Terri Schiavo’s death. The case perfectly demonstrated the importance of a Living Will, Healthcare Power of Attorney and Advance Directives.

Where can I get a Living Will?

A Living Will is a part of a complete Estate Plan and usually does not need to be prepared by a legal professional. You may be able to find one in a local library. A local hospital or care home may also have at least parts of a Living Will.

Most online Will writing service providers include a Living Will service. At USLegalWills.com you can prepare a Living Will in about 10 minutes.

How much does it cost?

The Living Will service at USLegalWills.com costs $19.95 and is usually sold as part of a complete estate plan. Estate planning attorneys will offer to prepare a Living Will for you, but if you just need this one document, you would probably not need to work with an attorney. Some hospitals may be able to provide the document at a very reasonable price.

Your funeral wishes

What are your funeral wishes?

There is a very common misconception that your funeral wishes, including preferences for burial or cremation, are included in your Will. There are a couple of reasons why this doesn’t really make sense.

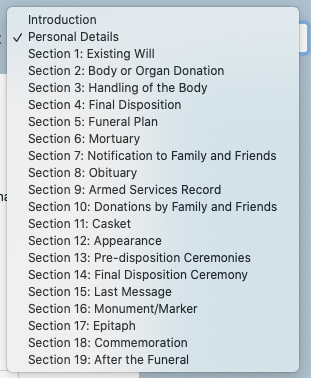

Your funeral wishes are not legally binding. They are simply an expression of your wishes that direct your family and loved ones. They do not have the legal requirements of a Last Will and Testament, and so can be informally updated without necessarily gathering together witnesses in the same way as your Will.

Your Will also has to go through formal court proceedings including probate before it is accepted as your official Last Will and Testament. By the time this is complete, your funeral is probably already done.

The funeral wishes service at USLegalWills.com covers burial, ceremonies, obituaries and other key topics related to your funeral.

What happens if you haven’t documented your funeral wishes?

If you do not express your funeral wishes, you are leaving a number of decisions in the hands of your loved ones. This can cause rifts between family members, but also put pressure on loved ones at a vulnerable time.

It is not unusual for funeral homes to try to maximize their sales related to funerals. For example, in choosing a casket, loved ones are often made to feel that the quality of the casket reflects the status of the individual. However, you may personally feel that the money spent on a luxurious casket would be better used on a child’s education. By expressing this in your funeral wishes, your loved ones are given guidance without having to make emotional decisions.

Where can I get it?

There is no official legal format or template for this type of document. You can really just write it out on a piece of paper and store it with your Will. The service at USLegalWills.com guides you through the decisions, but many funeral homes offer paper-based templates for documenting the same information.

How much does it cost?

You should never pay for this document. It is not a legal document and at USLegalWills.com we do not charge for the MyFuneral service.

An inventory of your assets

What is an asset inventory?

You do not list an inventory of your assets in your Will.

You don’t know when your Will is going to come into effect, and your assets are likely to change over time. This would require you to update your Will every time you opened a new bank account, or made a major purchase. Furthermore, once a Will is probated, it becomes a public document that everybody can read. You may not want details of all of your assets made public.

If a particular item has a specific beneficiary that is different to the main beneficiary of your estate, then yes, it must be included. So if everything is going to say, your son, except for a piece of art which is going to your nephew, then the piece of art has to be included in your Will.

But this makes things difficult for your Executor (or the person appointed through a Financial Power of Attorney). Your Will typically refers to “my estate” either all going to a single beneficiary, or being divided between a number of beneficiaries.

It is then the responsibility of your Executor to gather your estate, secure it, and then distribute it to your beneficiaries.

What happens if I don’t have an inventory of assets?

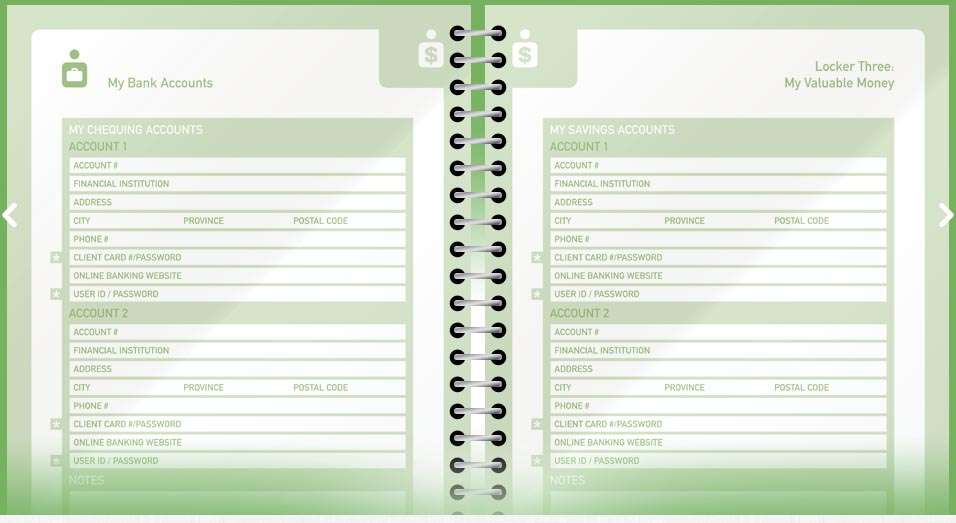

Imagine having to gather a list of every asset that you have right now. It will take a while. This includes every possession, every bank account, every investment, and also every online account.

If you think this is difficult, imagine having to do the same thing for somebody else.

This is the task facing your Executor.

Your Executor never really knows that the task of locating all of your assets is complete. They never really know that they have found everything.

Without an inventory of your assets, you run the real risk of an asset not being discovered – whether this is cash stored at home, or a bank account that you rarely use.

What will happen to your domain names? your PayPal account? your income from your YouTube channel. Assets are varied and distributed, and the task has never been more difficult for Executors.

Where can I get it?

This can be a simple form that you prepare yourself, or you can use a more sophisticated online service for doing this. There are a growing number of businesses that have recognized the problem and are trying to solve the issue of missing assets.

At USLegalWills.com we offer the MyLifeLocker service, the complete handbook for your Executor. The document can either be kept online to be accessed by designated “keyholders”, or printed out as a PDF file. When this document is stored with the Financial Power of Attorney and Last Will and Testament it is the final piece of the complete estate plan puzzle.

How much does it cost?

If you prepare this form yourself, then clearly, it will cost nothing. Online services do typically charge, and often as an ongoing subscription.

The LifeLocker service at USLegalWills.com costs $29.95.

What documents do you not need in a complete estate plan?

There are a variety of other documents that you may or may not need. For example the Revocable Living Trust.

A Revocable Living Trust is an attempt to reduce probate fees by moving all of your assets into a separate trust. The assets are no longer a part of the estate covered by your Will.

This is important because in most US States probate fees are charged on a sliding scale based on the value of the estate. By moving everything out of the estate before you die, you reduce the level of probate fees.

However, depending on which State you are living, probate fees are generally not that egregious, and the cost of setting up the Revocable Living Trust (as well as the time booking various meetings with an estate planning attorney) can by far outweigh the cost savings.

If you are looking to put together your complete estate plan today, the incorporation of a Revocable Living Trust adds a significant amount of time and expense to the process. And often this is with negligible benefit.

There are many online Will writing services, but a Revocable Living Trust generally requires legal expertise to set up. It is more difficult to use a pro-forma online tool for this type of trust, so it becomes much less convenient.

The other document that you may be looking for is a Pet Trust. You do not need to create a separate document to cover the care of a pet. This is usually incorporated within any well designed Will writing service.

The complete estate plan

These are the elements of a complete estate plan. You can get all of these documents at USLegalWills.com and the total price would be a little over $100 (if you needed them for a couple, your spouse would receive everything at a 40 percent discount).

The whole process for preparing your complete estate plan would take in the region of an hour. The Will itself takes about 20 minutes, the other documents are more straightforward.

The most time consuming part of this process would be gathering an inventory of your assets.

We do recommend that you get started as soon as possible. The reviews that we receive universally share the sense of relief for finally getting the documents in place.

Preparing your complete estate plan is something that we all know we should do, and we all procrastinate. Get started today, and trust me, you will be glad that you did.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020