Why you should name guardians for children

Many people think the time to make a Will is when they’re old and two steps from the grave. That is not the case. Whenever anyone begins to acquire assets or income, they should think about a Will. On the personal side, whenever anyone becomes a parent, they need to anticipate that they may not survive until the child becomes an adult. It may be unlikely, but having a Will in place provides some insurance, and allows you to name guardians for children.

These are some of the main advantages of having a Will if you have children. If you have children, a Will is a must.

Naming guardians for children.

A guardian of is someone who takes the place of the parent and assumes the responsibility of raising the child until the child reaches the age of majority, typically 18 years of age. Raising the child means caring for their education, attending to all the child’s health issues, providing a set of moral and religious values, participating and monitoring the child’s social life, and providing the full range of general welfare care and love that every parent is expected to provide for a child.

Appointment of the guardian.

The guardian can be appointed in a Will. If just one parent dies, then normally the other parent takes care of the child. But if both parents are killed or die, then the minor child needs someone who will raise him/her. If both parents are alive, then typically both parents create Wills which provide that on death a specific person, usually a relative, will be appointed as the guardian of the child.

Which person to choose?

Choosing the right guardians for children can be one of the most important decisions parents will make. There are pros and cons to many choices. It may seem easy and natural to choose the child’s grandparents but age is an important consideration. Grandparents may seem physically and mentally fit when the child first comes into the world but if a guardian has to be appointed 15 years after birth, the grandparents may not have the energy to raise the children.

The right sibling can be a good choice provided the sibling is a stable person. Siblings with a spouse are a logical choice but it is not normally necessary that an adult sibling be married.

Aunts, uncles, and other family members can be considered. Non-relatives who are friends of the parents might also agree to be a guardian.

As a rule, it is wise to consult with the prospective guardian before naming guardians for children in the Will to make sure they are agreeable to raising the child.

Naming Guardians for children at USLegalWills.com

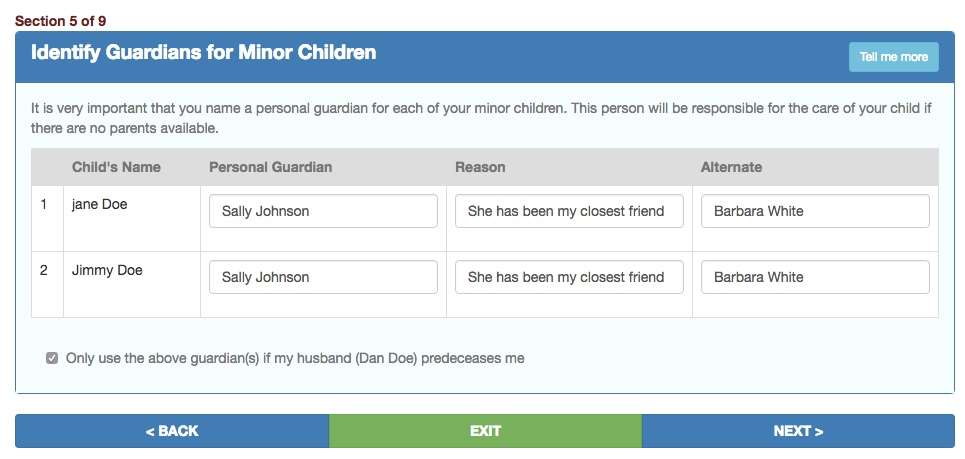

At USLegalWills.com we make the process of naming guardians for children a simple part of the Will writing service. As you step through our MyWill service, you will identify your family structure, and indicate whether or not you have children. You will then enter each child’s date of birth, and if they are a minor for your State, then a trigger will be set to prompt for naming a guardian later on in the service.

As you can see, you can not only name a guardian, but also provide a reason for the chosen appointment. You can then name an alternate guardian in case your first choice is unwilling or unable to serve.

Without a will, the decision who raises the child is made by the courts.

If different relatives such as a grandmother and a sister both think they should raise the child, then a dispute over guardianship will take place with the child in the middle. If there are no relatives, then the child will need to be placed with a governmental agency unless foster parents and adoptive parents take an interest in the child. The best option is to have a Will so the court doesn’t have to decide.

Distribution of the Assets

Parents accumulate many different types of assets during their lifetime. Some of the reasons to have a Will vary depending on the type of assets. Wills can address the following assets and situations:

- The house. If the parents are both deceased, then the question of what happens with the house is often tied up with who is appointed the guardian. Normally, the child will move into the home of whomever is appointed guardian and the house where the child was raised before the death of his/her parents will be sold.

In some cases, though, it may be a better solution to keep the house and make the payments until the child reaches the age of 18. The parents can use a Will to designate that the house will stay in the family this way. The testator, the person who makes the Will, may think the house is a good investment or may think that the child may want to live in the house when he/she becomes an adult. Keeping the house may make sense especially if the minor child is near 18 years of age.

- Specific assets the parent wants the child to have. A parent may want to make sure that not everything is sold. Some personal items such as family albums, digital possessions, cars, furniture, jewelry, recreational equipment may have sentimental value for the child. A will can make sure those items can be used by the child and can be formally given to the child when he/she becomes 18.

- Remaining assets. Most assets will be sold. After the debts, taxes, and estate administration expenses are paid; the remaining amounts should be available for the benefit of the child/children. How these assets are handled is decided by the guardian of the property – unless a trust or some other legal arrangement is made

Naming a personal representative

In a Will, the parent can appoint the person who will be responsible for administering the estate. In most Wills, the other parent will be named the personal representative. To cover the possibility that both parents may be deceased, an alternative personal representative should be appointed.

The personal representative is the person or organization that has the duty to make sure the Will is probated properly, that the right bills are paid at the right time, and that the instructions set forth in the Will are carried out. A personal representative can be a family member, a friend, a professional, or a business entity such as a bank.

If there are contests over the collection and distribution of assets, the management of the property, and the appointment of guardians of the person and property – then the personal representative, with the approval of the court, can control how those disputes are handled.

A good personal representative maximizes the amount of funds that can be used for the benefit of the child/children.

Naming a Personal Representative at USLegalWills.com

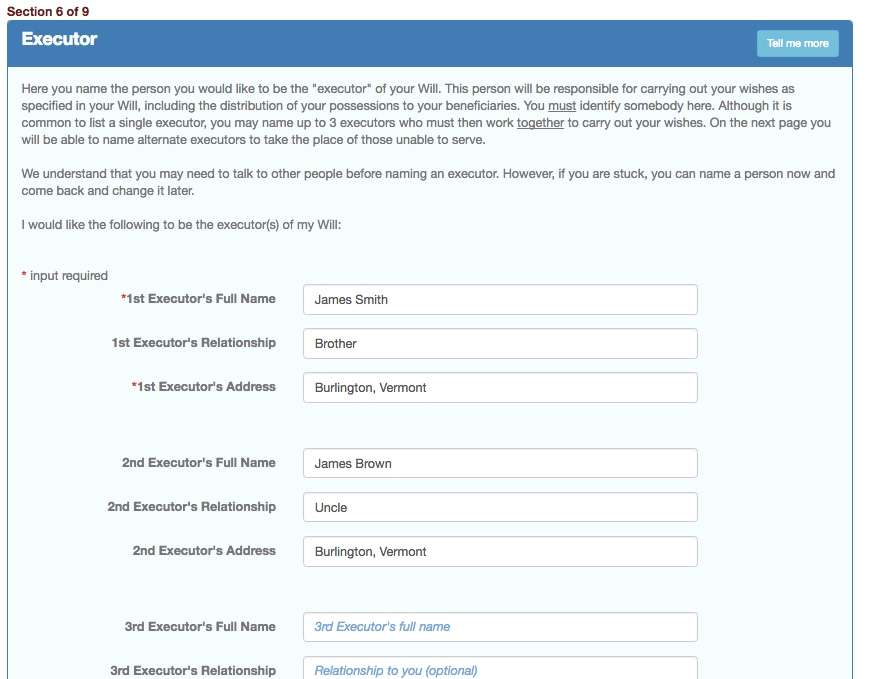

Your Personal Representative is also called your Executor or Estate Trustee. At USLegalWills.com we allow you to name your Executor as part of the Will writing service.

Our service allows you to name up to 3 Executors who would work together to manage your estate. We also allow you to name up to 3 alternates in case any of your first choice are unable or unwilling to serve.

Naming a guardian of the property

Once all the funds and assets such as the home and bank accounts are collected and properly titled, they should be used to help make sure the other parent or guardian can use those funds for the child – but in ways that will maximize having money available throughout the child’s life.

A Will is useful to help manage the remaining assets in the following ways.

- The Will can appoint the guardian of the property. This should be someone who is good with money management but who also understands and cares about the child. A relative, professional, or organization is typically appointed. The parent should speak with the potential guardian of the property before writing the Will to make sure the person or entity is capable, responsible, and does want to help out. For young children, the guardian of the property may need to manage the funds for up to 18 years

- The Will can set forth the terms of property management. How the money is managed depends on the child’s living arrangements, educational needs, health issues, and general welfare. Effective property management should address all of those needs. Ideally, if there are enough funds, the money will last during the child’s minority -until he/she is over 18. After 18, unless the will sets forth other instructions such as putting the money in trust, the money is then made available for the 18-year old.

Additional questions that a Will can resolve

Many marriages end in divorce. Often one or both parents may remarry. Some new spouses can become step-parents to minor children. A will can set forth what interests the new spouse has, what the new spouse is expected to do for the minor child, and what rights the child has with regard to the new spouse or step-parent.

Sophisticated Wills can be used to create trusts that benefit the child/children. In these Wills, the parent creates the trust, funds the trust, appoints a trustee, and sets forth terms on how the trust will be administered.

If there are multiple children, the needs of all the children must be balanced with the needs of each child. In most cases, the guardians for children will be the same person for all the children. The guardian of the property will be the same for all the children. There may be exceptions especially if there is a wide variance in the ages of the children.

Creating trusts for young beneficiaries at USLegalWills.com

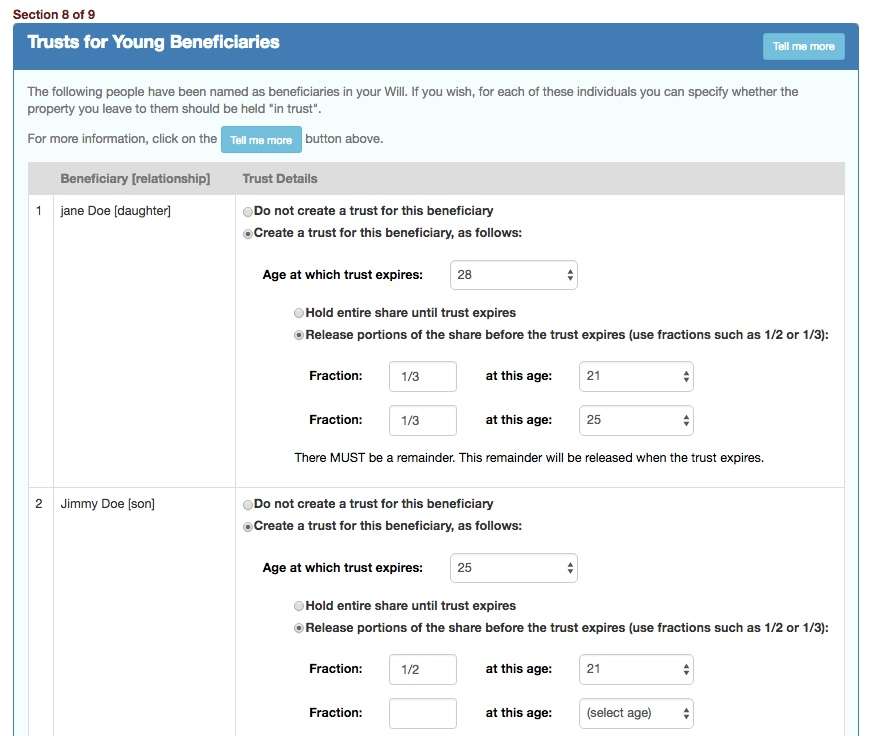

The service at USLegalWills.com provides totally flexibility when creating trusts for young beneficiaries. For each minor, you can determine the age at which they will receive their inheritance. But you can also split this across different ages. So for example, you may want the child to receive one third of their inheritance at 21 years of age, one third at 25 and the remainder at 28. Using our service you can set this up easily.

Now is the time to name your guardians for children

Of course, we all hope that your Will isn’t going to come into effect until many years into the future. If right, then it will simply sit in a drawer and gather dust, and this is fine. But for $39.95 and 20 minutes of your time, you can make sure that you have the right guardians named for your children. You can avoid the family court battles, and insure that your children don’t end up with the wrong person, whoever that may be.

Tim Hewson is one of the founders of USLegalWills.com.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets, and has contributed to articles in The New York Times, NY Metro Parents, U.S. News & World Report, and other leading publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...