We recently commissioned a survey to determine how many Americans didn’t have a Will. But we added a question that most surveys don’t ask; “Do you have a Will, but you consider it to be out-of-date?”. People often feel that it’s difficult to get their Will written. But updating a Will can be just as onerous and expensive.

For Americans over the age of 65, over 15% had a Will in place, that they regarded as out-of-date.

Traditionally, writing a Will has been an expensive and inconvenient process. You would need to make an appointment with a lawyer. If you lived with a spouse or partner, you would need to co-ordinate this appointment with their schedule. You may even need to arrange childcare. Writing a Will with a lawyer is rarely done in one visit. You may need to discuss certain decisions with loved ones. You would certainly have to return to sign the documents after they have been prepared.

credit: 123rf

credit: 123rf

As a result, people have traditionally thought of Will writing as a once-in-a-lifetime activity. They would wait until that perfect time in their life to write their Will. A point in their life when nothing would likely change.

The problem is, that time never came, and as a result 65% of American adults don’t have an up-to-date Will in place.

When Should I be updating my Will?

Family changes

After you’ve created your Will, you’ll most likely need to revisit them at key points in your life as your circumstances change. Listed below are some common life changes that will require updating your will:

1. You Get Married

If you have a Will, and subsequently get married, your Will is automatically cancelled in most US States (unless the Will specifically states that it is being written in contemplation of marriage).

If you do not have a Will, and you get married your primary beneficiaries change from your parents (or children if you have them), to your new spouse.

Prior to a marriage, the primary beneficiaries are generally parents, siblings, and children. After the wedding, the primary beneficiary usually becomes the new spouse. In most states, if you do not have a Will, a spouse receives one-third or one-half of the estate with the remaining portion being divided between the spouse and any children. Therefore, if you want to leave all of your property to your spouse, you’ll need to update your Will.

In addition to updating your Will, you should also be sure to change beneficiary designations on retirement plans and life insurance policies to include your new spouse. With second (or third) marriages where one or both spouses have children from previous marriages, estate planning is particularly important if you want to provide for the new spouse and be certain that all children are not disinherited.

It is also important to note that if you are living with someone but are not legally married and you want your significant other to inherit any of your property, you need a Will. Most US states do not recognize common-law relationships with intestate succession (dying without a Will).

2. You Have a Child

Upon the birth (or adoption) of a child, parents should plan for the possibility that they both may die while the child is a minor. Your Will should appoint a guardian for any minor children and create a trust for any funds that the child may inherit.

If no Will is in place, the court will appoint the child’s guardian and any inheritance would be held in a guardianship account until the child turns age 18, 19 or 21 (depending on the State), at which time the child would receive all remaining funds.

Having a new child is one of the most common reasons for updating your Will.

3. You Get Divorced

If you get divorced you may need a new Will altogether because in most states a divorce automatically revokes the provisions of a Will. This means that the ex-spouse is considered to have died for the purposes of the Will, and everything that they would have received will go to the alternate beneficiary. In some states a divorce cancels the entire Will.

4. You separate from your spouse

This is one of the most overlooked changes of family circumstances. If you have a Will in place naming your spouse as your main beneficiary, and then separate from your spouse, the separation has absolutely no impact on your Will.

Your estranged spouse will still be the main beneficiary of your estate. If you do not want your estranged spouse to receive your entire estate, you would should consider updating your Will.

5. You live “common-law”

The status of “common-law” or “cohabiting” is not recognized in estate planning. If you are living with somebody, and die without a Will, then your common-law spouse has no claim to your estate.

If you have an old Will and want your new partner to benefit from your estate, then you should consider updating your Will to include your partner. They do not automatically become a part of your distribution plan simply because you start living together.

Something happens to somebody in your Will

At USLegalWills.com we give people the option of maintaining an account with us so that they can make changes to their Will in the future. Many people respond to this by claiming that they are good, they won’t need to make any changes. But of course, you cannot know this.

You may need to update your Will if your alternate Executor is taken ill. Or your guardians move to Australia, or they have triplets of their own. You may have left a cash legacy to an individual who wins the lottery. This bequest may no longer have the significance that it did when they were financially struggling.

If one of your beneficiaries dies, or has children of their own, you may want to take another look at your distribution plan.

This is why it is quite possible that if you have written a Will with an estate planning attorney, it could be out of date by the time you get home!

Updating your Will when you change your mind

You may have created a distribution plan for your estate that makes complete sense to you. You may feel that it reflects your wishes, and that your wishes are not likely to change.

But supposing you witness the work of a particular charity, and that charity becomes an important part of your life. Or a person does something for you and your family, and you start to think of them as one of of your family. What if you were to drift apart from a family member, or something happens and you no longer feel the same way about a person or an organization.

Many people include charities in their Will, but occasionally a charity can become embroiled in a scandal and you feel that it is not as worthy a recipient of a bequest.

There are many unforeseen reasons why you may simply have a change of heart which prompts an update to your Will.

Do I need to update my Will if I move house?

No. If you change address, it doesn’t matter. Your Will simply needs to identify you, so if your Will says “This is the Last Will and Testament of me, John Doe, of 123 Main Street, Austin, Texas” and you subsequently move to First Avenue, the Will is still perfectly valid.

Even if you move States. A Will written under the laws of any State in the US, is accepted in any other State in the US.

If you update your Will, you should make sure that your new document complies with the laws of the State in which you are now living. But moving States alone does not require you to update your Will.

Different ways to write a Will

There are essentially three ways to prepare a Will

Use a blank sheet of paper or a DIY kit.

This is the cheapest approach to writing a Will, but the most dangerous.

Legally, you can write your own Will using a blank sheet of paper. You simply state that it’s your Will, and then describe what you want to happen to your estate. If it is all in your own handwriting, it is a special Will called a “holographic Will” which doesn’t require witnesses. This is the approach taking by Aretha Franklin.

Aretha Franklin’s Will

Aretha Franklin’s Will

It is quite simply, a terrible way to prepare a Last Will and Testament. Aretha Franklin’s $80M estate is still held up in litigation, and the only people who have received any money are the lawyers representing each side.

A Will is a difficult document to write with no legal training. You must name Executors, guardians, set up trusts, discuss the powers being granted to the Executor and Trustees, set up contingency plans in case your distribution plan doesn’t work.

Some kits provide a basic framework for writing the Will, but they still present too much space to make a mistake.

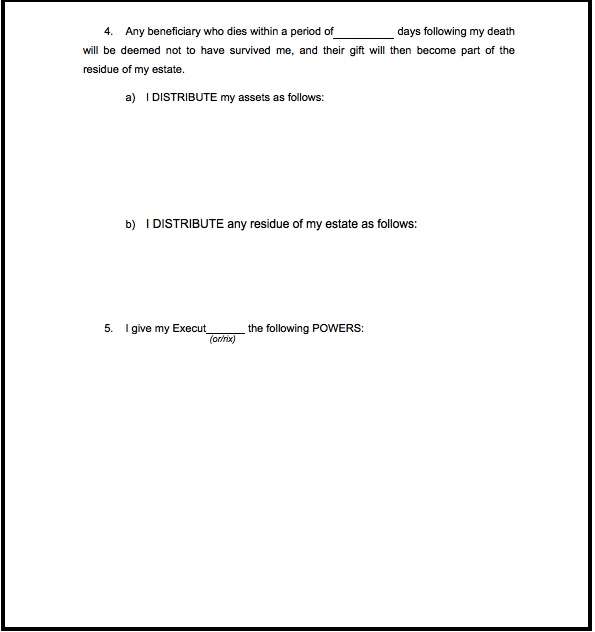

Blank Form Will Kit

Blank Form Will Kit

This kit gives you ample room to describe the powers for the Executor. It’s simply not possible to complete this without legal training.

The only advantage of writing your Will yourself using a blank sheet or DIY Will kit is that it is cheap or even free.

Write a Will with an estate planning attorney

At the other end of the spectrum is preparing your Will with an estate planning attorney. By taking this approach you have the opportunity to receive legal advice and possibly estate planning advice.

This means that depending on the type of attorney you work with, they may be able to structure your estate in the most tax efficient way. You don’t simply receive a Will, you should receive a complete estate plan.

Of course, this comes at a cost, both financially, and your time.

Most Americans don’t have a Will, and income level is not a good predictor of whether or not somebody has a Will. It’s not always a financial barrier, but most people who do not have a Will go without because it’s difficult to find the time to coordinate an appointment with an attorney.

Often writing a Will with an attorney requires more than one appointment, and usually this has to be coordinated with a spouse or partner if you have one.

In general, it can be a difficult process.

Write a Will using online interactive software

Sitting somewhere between the blank form Will kit and an estate planning attorney is the online interactive Will writing software. There are now close to a dozen companies offering this type of service in the US, and the prices range from free, through to about $150.

Aside from the affordability, the key advantage of this type of service is one of convenience. You can put your children to bed, put your feet up, and prepare your Will in the comfort of your own home.

USLegalWills.com

USLegalWills.com

Generally the process takes about 20-30 minutes. Your Will is compiled to be downloaded and printed. You then simply sign the document in the presence of two witnesses to make your legal Last Will and Testament.

As these services have evolved, they have built a number of complementary features. For example, at USLegalWills.com we have a free MyFuneral Service, we allow you to document your important information through a MyLifeLocker service, you can upload important documents to a Digital Vault. All controlled through a proprietary MyKeyholder service.

The Will services have also become more sophisticated, and now typically include options for pet trusts, lifetime interest trusts, digital assets, and some even include provision for non US assets. Like the MyExpatWill service available at USLegalWills.com.

Online services also generally allow updates to be made quickly and easily.

How can I update my Will?

There are essentially three ways to update a Will

1. Can I handwrite a change on my Will?

Legally, you can. You would simply write the change on your Will, and then initial the change and have two witnesses also witness this handwritten change.

It’s not a good idea to do this.

Handwritten change to a Will

Handwritten change to a Will

The changes in this sample would not be legal. Clearly, it is not obvious who made the changes, and whether they were made before or after the testator died. There are no witness initials or signatures to verify the change. The changes are also not dated.

Even a change as innocuous as the name of the Executor cannot be done without two witnesses (unless the document is entirely handwritten and you end up with an Aretha Franklin type mess…see above).

Because a handwritten change requires two witnesses to sign, there is no advantage to updating a Will this way. But it is much more likely to result in a challenge to the Will.

2. What is a codicil?

When Wills were written hundreds of years ago, they were a lot of work. They were handwritten, and usually looked something like this.

Credit: 123rf

Credit: 123rf

If after making your Will, you had a change in circumstance and needed to update it, you would have returned to your Will writer. It was not easy to edit a manuscript to reflect these changes, and you certainly wouldn’t want deletions and annotations on your document.

The solution was a codicil.

This is a separate document that makes reference to the original. It would say something like “for clause 3, the Executor, instead of my brother Brian Green, I appoint my sister Susan Brown”. The codicil would then be signed in the presence of two witnesses, and the neat integrity of the original Will is preserved.

Of course, nowadays, we have computers and printers, so a codicil doesn’t really serve any purpose. In fact they should be avoided because they can become confusing especially if there is more than one codicil. If a codicil makes reference to another codicil you can end up with an extremely confusing set of documents.

Bear in mind that a codicil has the exact same signing requirements as a Will. It must be signed in the presence of two independent adult witnesses. So there is no time saving in the creation of a codicil.

So in today’s world of Will writing there is no advantage to a codicil, and many pitfalls. So they should just be avoided.

3. Should I just prepare a new Will?

Yes. Always. Although there are legally three ways to update your Will, handwritten changes, and codicils are not recommended. The only way to correctly make an update to your Will, is to prepare a brand new document.

Your new Will would automatically revoke (cancel) any previous Will. It doesn’t have to make any specific reference to your previous Will. It just becomes your new document.

How much does it cost to update my Will?

The cheapest way to update your Will is to handwrite changes on the document. These changes still need to be signed in the presence of two witnesses, but it allows you to update your Will at no charge. But as we discuss above, it is not an approach that we would recommend. It makes your Will very easy to challenge.

If you have written your Will with a estate planning attorney and want to update that Will prices vary. We have heard of estate planning attorneys charging on a “per change” basis of $100 per update. So for example if you wanted to change the name of your Executor, and add a charitable bequest, this would be two changes. If you returned to your existing estate planning attorney who already had your Will on file, they may make these changes for you for a couple of hundred dollars.

However, in most cases, an attorney would see this as an opportunity to review your existing Will to see if the rest of the document still reflects your wishes as well as your personal and financial situation.

Often, making a minor change with an estate planning lawyer costs the same as preparing a brand new Will, at a cost of $600 to $1,000.

If you are updating your Will by preparing a new Will, then you can look at other options for writing a Will including an online Will writing service.

In fact, many people who turn to services like USLegalWills.com come to us because they have previously written their Will with a lawyer, and want to make a relatively minor change. On being quoted $800 to make the change, they look for other options, and find our service for $49.95 which allows future updates at a fraction of the cost.

Do I need to see my old lawyer to update my Will?

In general it is not a good idea to have multiple Wills in circulation, with some having been written by a lawyer, and some written by yourself. It can be confusing if multiple Wills are submitted to probate.

However, it is quite natural to feel reluctant to tell your estate planning attorney that you are making your own plans for preparing a new Will. For example, the $49.95 option at USLegalWills.com, instead of the $800 charged by the attorney.

Legally, as soon as you sign and date your new document in the presence of two witnesses, your old Will is revoked. There is actually no requirement to retrieve your Will from the lawyer’s office. It is cancelled as soon as the new Will is signed.

You do not have to make an appointment with your lawyer to cancel the Will previously written by that lawyer.

Can I update my Will without a lawyer?

Yes. In the same way that you can prepare your own Will without a lawyer. There is absolutely no requirement to use a lawyer to write or update a Will. To make any update to your Will legally recognized, it simply has to be signed in the presence of any two adult witnesses.

This also applies to writing a new Will. If you prepare a new Will using a service like the one at USLegalWills.com, there is absolutely no requirement to use a lawyer. You simply sign the document in the presence of any two adult witnesses who have nothing to gain from the contents of the Will, and it becomes a legal document.

You can if you wish have the document notarized, by having your witnesses sign an “affidavit of execution” and attaching this to the Will. This is an optional step that does not make the document any more legal. It is called “self proving” a Will, and not an accepted process in all States.

If I write a Will at USLegalWills.com what happens to my old Will?

The first clause in all Wills written at USLegalWills.com states

I, Mr. John Doe, residing in New York City, in the State of New York, United States of America, being of sound and disposing mind and memory, do hereby make and declare this to be my Last Will and Testament, revoking all prior Wills and Codicils.

This clause “revokes” (cancels) all previous Wills. It means that as soon as this document is signed and witnessed, all previous Wills are voided. You can only have one Last Will and Testament.

It is a good idea to destroy any old copies of your Will, but it is not a requirement. Previously dated Wills are no longer in effect and do nothing.

How can I write a Will at USLegalWills.com?

USLegalWills.com guides you through the process for writing a Will. You work through ten sections that ask you about your family status; whether you are married, have children or grandchildren. You then make key appointments like your Executor and Guardians for children if applicable.

You are then prompted to describe the distribution of your estate, either by selecting one of the options, or describing the distribution yourself.

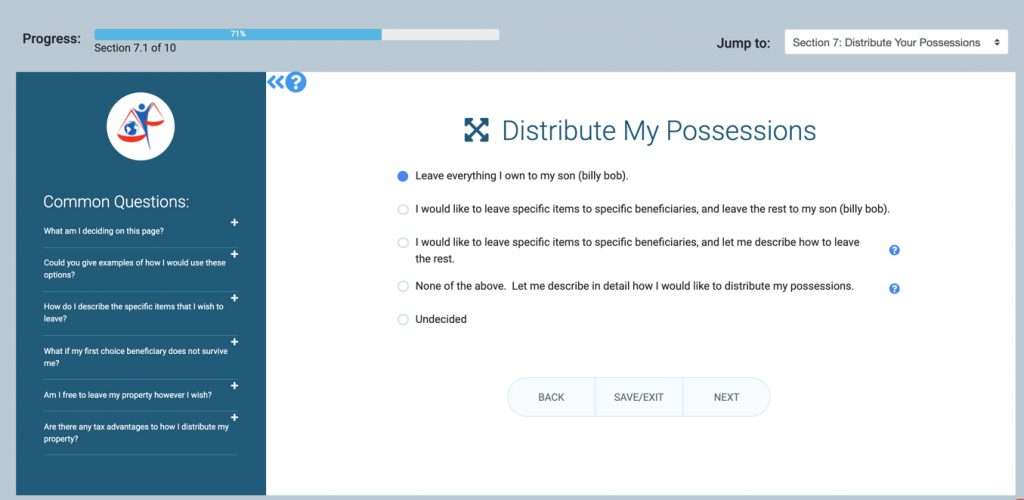

Distributing your estate at USLegalWills.com

Distributing your estate at USLegalWills.com

This distribution of assets can include charitable bequests, as well as making provisions for pets.

The service also allows you to set up trusts for minor beneficiaries.

Once you have stepped through the service, you can download your Will. The cost for the Will service is $49.95 and gives you one year of unlimited updates with that initial payment.

You then print your Will and sign it in the presence of two witnesses to make it a legal document.

How do I update my Will at USLegalWills.com

The Will service costs $49.95. With this payment, you are able to prepare your Will, it also gives you one year of unlimited updates to the document. You are able to print the document as often as you wish during that first year. You can download it as a PDF or Word file, but to make your document a legal Will, it must be printed and signed in the presence of two witnesses. The online version is there for your convenience only.

If you choose not to maintain an account with us after the first year, your initial payment is all you will ever pay. We do not keep credit card details on file and cannot automatically charge beyond this initial payment.

You can if you wish choose to store your documents online for longer than a year which will make it easier to make updates in the future to reflect any changes in your personal or financial situation (rather than returning to a lawyer each time). This is of course optional, but it does make the process of maintaining your document more convenient. $11.95 will give you one additional year of updates, or you can purchase multiple years e.g. 5 years at $24.95, 10 years at $34.95, 25 years at $74.95 ($3 per year).

Every time you make an update to your Will, it must be printed and signed in the presence of two witnesses again. If you choose not to maintain an account with us, you will always have your printed, signed document. If you don’t need to make changes to that document, it will last you for the rest of your life, whether or not you have an account with us.

Write your Will today

The nice thing about writing a Will at USLegalWills.com is that no appointment is necessary. You can write it this evening, or at the weekend. You can start it today, and finish it next week.

The key is to get started.

Tim Hewson is one of the founders of USLegalWills.com.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets, and has contributed to articles in The New York Times, NY Metro Parents, U.S. News & World Report, and other leading publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...