As with any task that comes to mind on odd occasions in your life, writing your Will can seem overwhelming. So much so, that most people don’t do it. However, if you are coming to this page, something that probably happened in your life to make you realize that writing a Will is a vitally important task.

Sadly most people who feel an immediate need to prepare their Will just do a Google search for a local estate planning attorney. They make an appointment, pay several hundreds or thousands of dollars and live with the peace of mind that the task is finally off their To Do list. As long as they don’t need to update it.

Copyright: woodsy007 / 123RF Stock Photo

However, with a little research, you will quickly understand that writing your Will needn’t be difficult, inconvenient or expensive

Here are ten quick steps to writing your Will;

1. Decide that writing your Will is important

Every adult should have a Will, but sadly most don’t. The arguments for not preparing a Will include

“I don’t have any assets worth leaving”

“Everybody knows what will happen to my things when I die, I’ve told everyone”

“It’s obvious what will happen to my things, it will all go to my spouse”

“I’m too young, I’m not going to die anytime soon”

“I don’t care what happens, I’ll be gone anyway”

There are gaping holes in all of these arguments.

You don’t know what you will be worth when you die. Even if you were hit by a bus tomorrow, your estate could be very valuable. Supposing the bus driver was texting, and your estate won an accidental death payout from the insurance company. What will happen to the millions of dollars in your estate.

This is just to illustrate that Wills are not just for the wealthy, and you are not writing your Will to distribute everything that you own in your house right now. One of the objectives of writing your Will is to distribute your estate, but there is much more to it than that.

It is also not obvious who will receive everything. If you are married with children there are actually very few States that pass everything to your spouse if you don’t have a Will. And each State is different.

Most importantly though, not having a Will leaves chaos. Nobody has been appointed Executor of your estate, nobody has been named as a guardian for your children, and nobody really knows what to do. And if the consequence is anything like Prince, or Amy Winehouse, or countless other celebrities who have died without a Will, the lawyers will be the winners.

2. Think about your key appointments

The first few steps in writing your Will are the planning steps. No matter which approach you take to writing your Will, you are going to have to give some serious thought to your key appointments.

The Executor of your Will

You must name an Executor in your Will. This person has the responsibility to carry out the instructions in your Will.

Your Executor must probate the Will, at which point the courts grant them the authority to act as your estate administrator. The courts issue the Executor a document that allows them to approach banks and other financial institutions and collect your assets.

The Executor must also secure your assets. One of the dangers of dying without a Will is the horrific site of family members descending on a property and picking through family heirlooms. Nobody is there to take charge, and it invariably leads to family tensions.

Once your assets are secure, the Executor must pay debts, taxes and make funeral arrangements.

Your Executor appointment must be somebody who is trustworthy, strong in dealing with family members and loved ones, and also methodical enough to work with the IRS to file the appropriate paperwork. If you don’t have anybody who meets these demanding qualifications, you can always name a bank or law firm.

Be aware though that if you do name a professional estate Executor, they will likely charge a percentage of your estate of around 3 percent, as well as often charging an hourly rate on top. It is an expensive option (and rarely good value for money).

Guardians for your children

The second vital appointment in your Will is the guardian for your children. If both parents of a minor child become unavailable, then the family courts have to appoint a guardian. Hopefully family members will present themselves as candidates to take on the responsibility. But a judge will make the decision.

A judge will not have much to work with as they will not know the people in front of them. They may know about their income and their family situation, but will know nothing about their values and your preferences.

Copyright: stockbroker / 123RF Stock Photo

The judge will look for guidance coming from your Last Will and Testament. All things being equal, if you name somebody in your Will, then the judge will grant guardianship to this person.

It’s not an easy appointment, even for you. There are many things to consider including financial means, moral values, closeness with the children and their own family circumstances. Often grandparents are considered the obvious appointment, but the guardianship may not come into effect for another decade, and with a decade passing, the grandparents may become too elderly to take responsibility for the raising of children.

It is your decision, and one that demands careful consideration before writing your Will.

3. Think about the distribution of your assets

When you think about writing your Will, you probably think in terms of distributing your assets. Not just your bank accounts, but family heirlooms and objects that are meaningful to you. Your assets include everything you own, your money, your property, and your investments. In addition, it can include your digital assets. It may make sense to appoint somebody to make sure that somebody manages your online presence.

Digital assets also include items that can have financial value. You may have domain names, advertising revenue, blog traffic, ebooks available for download. Somebody needs to manage this.

You can leave your estate to whomever you wish. Bequests include specific items, for example, a watch or a car. Or you can leave sums of money. The bulk of your bequests will be in the form of a percentage of your “residual estate”. This is everything that is left over after the distribution of debts, taxes, funeral expenses and specific bequests.

It is a very common plan to leave your entire estate to an individual, or to share your estate between a few different people. For example “I leave my residual estate to be divided in equal shares between my three children……”

This would also be a time to think about charitable bequests. Leaving money to charity in your Will is often called “planned giving” and is a great way to make a meaningful difference to the World, with very little impact on yourself.

Some charities are promoting the idea of leaving “one percent” of your estate to charity. It makes very little difference to your beneficiaries, but can be worth tens of thousands of dollars to a charity.

4. Consider alternate plans

For many people, their distribution plan is obvious, but it is the “what-if” scenarios that become challenging. When writing your Will you have to imagine every permutation of people pre-deceasing you. So if you are married with no children, it would be obvious that the bulk of your estate would likely pass to your spouse. But what if you were both in a common accident?

Even if you have children, if one child were to pre-decease you, would their share go to your other children? Or would their share go to their own spouse or children?

It is very important when writing your Will that you cover every possible scenario. The service at USLegalWills.com help with this by guiding you through alternate plans and even second alternate plans. Your Will should even have a plan in the unlikely situation that your whole family is in a common accident. It’s a horrible thought, and will probably never happen, but your Will should cover it anyway.

5. Consult with family members when necessary

Now that you’ve give some consideration to your appointments and the distribution of your assets, you need to decide if some family discussions are in order. You will have to get over the “why are you writing your Will? are you sick? you’re not thinking of doing anything stupid are you? are you depressed” types of reactions. Just explain that writing your Will is a part of responsible financial planning, and you don’t expect it to come into effect for many decades into the future.

At a minimum, you should discuss your appointments. Your chosen Executor has every right to refuse the appointment. It is better that they do this before you write them into your Will, rather than after you have died. You can then make other plans.

Depending on your family situation, it may make sense to talk to the person named as guardian for your children. And even talking to the people who are not named as guardian. Again, anybody can apply for guardianship and your Will is simply a guide for the judge. Your children could still face a custody battle if your family are not on board with your decision.

6. Choose an approach

You are now ready to write your Will, and there are broadly three approaches available to you:

Work with an estate planning attorney

This is the most expensive and inconvenient option, but does address every need. For example, if you had a child with special needs and you want a trust set up for them through your Will, an estate planning attorney should be able to do this. If you were earning royalties from a piece of work and want to include these royalties as bequests in your Will, then a specialist in estate planning law would be able to draft a clause for this.

If you needed to optimize your estate to minimize probate fees and taxes, then an estate planning attorney may be able to help with this. However, it is possible that the fees associate with this outweigh the savings. You would have to do this calculation.

If you have a good idea of how you wish to distribute your estate and don’t feel that you would benefit from custom clauses, or specific legal advice, then the fees demanded by an estate planning attorney may be unnecessary.

Writing your Will yourself or with a kit

This is the opposite end of the spectrum that can be free or minimal cost. It’s just a really bad idea though. Writing a quality, legal Will is difficult. Keep in mind that even a highly paid estate planning attorney does not write a Will starting with a blank piece of paper. They use software that inserts well established legal “precedents” . These are clauses that work because they have been a part of countless previous Wills.

Even if you use a blank form kit, there are just so many things that can go wrong. People try to list all of their assets, make conditional bequests that don’t make sense and rarely adequately describe alternate plans.

The conditional bequests is a classic error. When you are writing your Will you say “I leave everything to my son only if he has a child”. How long does your Executor have to wait for this event to happen? Your son may father his first child at 60 years of age. Your estate will be in limbo for decades.

We would advise you to stay well clear of free services, blank form kits, and writing your own Will.

Online interactive services

An increasingly popular approach to writing your Will is through online interactive services like the one at USLegalWills.com. The service guides you through the process, rather like tax preparation software. You answer a series of questions at the end of which we generate a custom document. You can then download and print this document to make a legal Last Will and Testament.

The services often use the same software used by estate planning attorneys, but give you direct access to it. So the end result is a document that is word-for-word identical to one prepared by a lawyer.

Of course, you pay a fraction of the fees charged by a lawyer. You also have the advantage of writing your Will from the comfort of your own home. As well as having the option to update your Will at any time to incorporate changes in your personal or financial situation. It is a document that offers the quality of a professionally prepared Will, at the price of a blank form kit.

7. Make your document legal

This is such a simply step when writing your Will, but one that lawyers use to scare people. You have to sign your document to make it a legal Will. But it must be clear to the probate courts that nobody put you under pressure into signing something you didn’t want to sign. The law therefore requires that to independent witnesses watch you sign, and then sign themselves to say that they witnessed you sign the document. They are signing to say that you were under “undue influence” and you knew what you were doing.

Obviously, the witnesses cannot have a vested interested in the contents of the Will. They cannot be beneficiaries otherwise it would defeat the purpose of witnessing. They should also not be related to beneficiaries. However, they can be an Executor and this is very common when writing your Will through a lawyer.

Copyright: stockbroker / 123RF Stock Photo

Your witnesses can be friends, neighbors or co-workers. As long as they have no vested interest in the document, if all three of you sign your document all in each other’s presence, then it becomes your legal Will.

An important point here is that there is no requirement to notarize, stamp, register or sign the document in the presence of a lawyer, notary. Nor do you need to take an oath, sign an affidavit or file it with the courts.

8. Store your document

Not a day goes by at USLegalWills.com when we don’t receive this call;

My father wrote his Will, but we cannot find it. What do we do?

This is a sad situation because somebody has made the smart decision to prepare their Will, but didn’t take the important step of telling their Executor where it can be found. The result is that they may as well have not bothered to prepare their Will.

Do not hide your document so that it cannot be found. It must be kept in a place that is known and accessible to your Executor. Some people just give it to their Executor in a sealed envelope for safe keeping. This way, if there is a house fire or flood, you do not lose your Last Will and Testament.

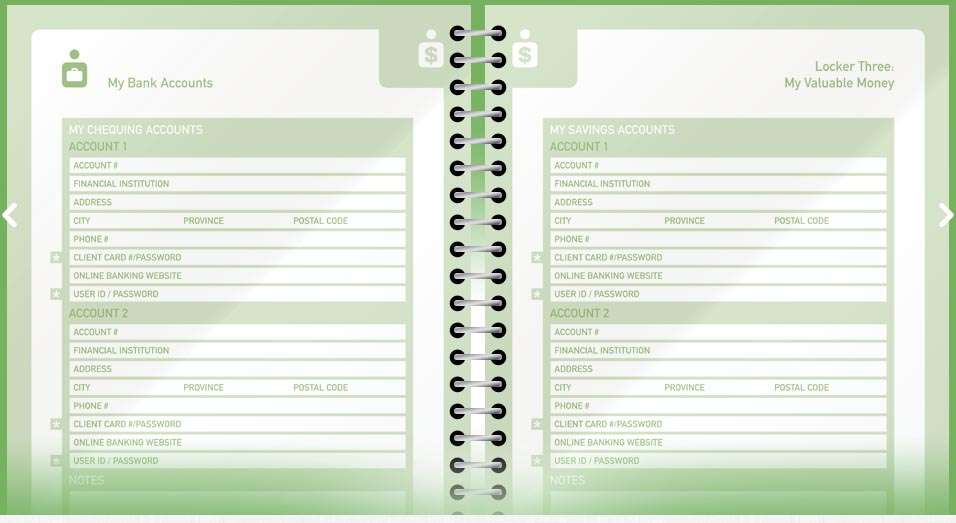

9. Document your assets

Once your Will is probated, and your Executor is given the authority to act as your estate administrator, they have to secure and gather up your assets. Ask yourself this question. If you were to die today, would your Executor be able to find all of your assets?

Years ago, an Executor could look through your files and collect bank statements. This would give them a fairly good idea of your assets. Thirty years ago people had one or two bank accounts (usually with the same bank) and a stack of bank statements. Life isn’t like this anymore.

Your Executor would probably need access to your email account, and login IDs and passwords to even start to collect your assets.

At USLegalWills.com we offer a Executor tool called MyLifeLocker. It allows you to maintain an inventory of your assets which you can update over time. It makes your Executor’s task manageable, and most importantly insures that your assets do not go undiscovered.

10. Update it when circumstances change

You are finally done. You have planned and written your Will, stored it safely, and documented your assets. The only final consideration is to review it on a regular basis. Make sure that your appointments are still be best choices. Are your beneficiaries still in the same situation? do you want to add any bequests to charities for example? Has one of your beneficiaries suddenly had their own windfall? Has your guardian had triplets of their own?

There are countless reasons why your Will may no longer reflect your wishes. So once in a while, have a read through it. If you want to make a change, and you used USLegalWills.com, you can just login to your account, make an update, and then print and sign a new document.

Writing your Will is not a difficult process. Everybody needs a Will, so don’t put it off any longer. Writing your Will can take you less time than it took to read this article !!

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020